When I first began to do breadth and

weekend reviews I admit I was looking for greater certitude from my

analysis but what my trades have reinforced is that at best even this

is a coin flip so I've begun to place more emphasis upon extracting a

probability matrix based upon how I've actually traded under previous

market conditions that approximate current market breadth. There are

periods where the market is more forgiving to my foibles and

conditions when the market is more punishing. Thus far this year I

have a winning percentage of 54% on my trades, and this was under

what I considered to be favorable conditions.

This past week there was a big red

warning sign that conditions are becoming less than favorable for my

trading. On Wednesday when the there was a sell off with 351 stocks

in my universe down 4% I immediately took action and liquidated

positions that I had taken over the previous couple of trading

sessions. This was significant enough information for me to not

focus upon the potential of the trades but to draw down the size of

my risk exposure to a comfortable level. I've come to accept through

experience that in this situation my level of discomfort increases

and my ability to manage trades decreases as I have a tendency to be

more mistake prone under this mental state.

What this sell off did was move a

condition under which I trade well to one under which I perform

poorly. When the 10 day differential is in positive territory I have

greater success in my trades with higher probability of follow

through and when it is negative there is a decreasing probability of

follow through and successful trades as well as account churning.

This is information directly from my trades so I've learned to take

the appropriate action of risk control immediately and limit market

exposure. The following graph identifies the periods over the 250

trading sessions where there conditions have been met.

|

| 10 Day Differential |

As far as I am concerned, what this

data informs me of is that regardless of what ever else is going on,

for what ever reasons I trade poorer when this condition is met so

take appropriate measures. As this move develops over time it may

become clearer if this is due to a pullback or deeper correction, yet

however time determines the market action it simply is not conducive

to me in this moment and this moment is the only market I can trade.

It's been clear for some time that this

market has been extended. A look at the T2108 shows there was an

extreme reading of over 80 in January which peaked at 85 on 01/25 and had a

steady decline thereafter before a flush over this past week that

took it from 70% to 56%. A glance at the previous year during this

time frame shows a similar occurrence followed by a bounce.

|

| T2108 |

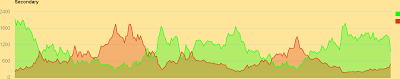

This decline also shows up on the intermediate

time frame. Of particular note is that while the T2108 reached

similar levels to last year, the reading reached on this indicator

was much more modest. This may have implications in terms of the

type and/or severity of a market pullback.

|

| Secondary |

The Primary I use also reflects a

severe drop over the past week. This reading is now at 17%, down

from slightly over 20% the week prior and remains at extremely

overbought levels here.

|

| Primary |

One of the biggest challenges is

learning to trust one's read on the current conditions and having the

confidence to execute one's plan in the face of the cacophonous echos

of the market machinations that strip traders of their capital.

There will always be opinions of others and while it is important to

be vigil in constantly educating oneself about market mechanics it's

also important to develop self-reliance and trust in one's own

analysis to avoid becoming easy prey by being all too easily

persuaded by the thoughts of someone else.

All the information I need to decide

whether or not it is favorable to swing long positions currently

informs that now is not the time to be aggressive. It's better to

wait this action out until the next opportunity confirmed by breadth

arises. There are still a number of stocks setting up and as of now look like good long candidates but these could easily fail if persistent buying does not return to the market. One thing I'm keeping in mind is that even if there is a solid bounce from here stock selection will have to be very selective because from my perspective there hasn't been a deep enough sell off for a persistent rally. I determine rallies that start from Primary breadth extremes to be non-sustainable due to the narrowness of leaderships during these phases so tactical approaches to such moves becomes more critical.