Tuesday, December 13, 2011

Unhappy Medium

Last week there was a breadth thrust but what few set ups there were skewed from the multiple gaps. This week there are a plethora of set ups building but breadth is waning. Signs of frustration are building and the proverbial towels are in hand. If it weren't for choosing to do something else with my time these past two weeks I would have capitulated myself, but as is I opted to use my energy elsewhere and tinker around with my "Have yet to put thought into action to do list."

Sunday, December 11, 2011

Weekend Review 12/09/11

Back in November I wrote an article displaying the SPY chart, in part because all of my other charts were beginning to get a little messy and in part because I wanted to note price action over time without interference on and redrawing boxes and trend lines to suit my fancy of the moment. So today I've decided to draw a trend line extending from the peak of the last box I drew on the chart. It's clear that there hasn't been much progress in either direction and it is also become clearer that another range has formed.

|

| SPY 12/09/11 |

One of the significant distinctions to note between this range and the previous that began in February is the volatility. The range from February through July was –in comparison –quite orderly, while the current range since August has been quite erratic with very wide range bars and numerous gaps and a lot of emotion. News and Macro events have played a significant part in both ranges, but the bad news during the current phase isn't being shaken off so easily, and if we're to take the stance that markets are forward looking, the current consensus doesn't appear to believe this will be improving any time soon. It hasn't exactly degraded either.

One of the indications that events are being priced in to the up side will be a decreasing in volatility and compression of daily ranges. As of now, 2% down days followed up 2% up days are still consistently the norm. As mentioned in the Zanger article, bear markets slide down the slope of hope and this can be noted by the contempt, frustration and disgust of every 1%+ down day being quickly forgotten through the excessive optimism of the following 2% up day being the one: the one that ends, the cracks the bear market, the one that leads to a life time of riches, the one that makes all the toil worth while –that one.

Looking at what's led this week yet again, I don't believe that yesterdays move, or any of the 2%+ moves as of yet have been the one. Yet again, it's the JOB stocks getting squeezed like oranges leading this week:

|

| Top Gainers Week of 12/09 |

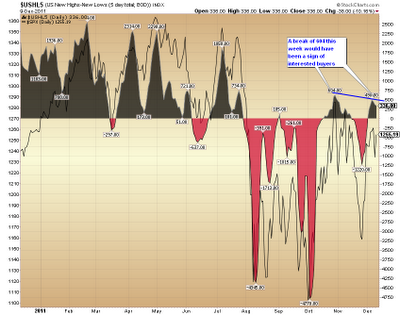

Further, the inability of the $USHL5 to clip the previous peak of 604 sends a strong signal that there is a lack of leadership in this move. There are definitely some quality stocks holding their own but there aren't enough of them just yet to indicate a difference in the mood of those that have the capital and means to move markets with their buying. I would argue the point that the primary reason this showed any gains at all this week is a lack of new lows due to bottom fishers and a bump in highs due to the dropping off of previous highs.

|

| $USHL5 12/09/11 |

Currently the market is fleecing both longs and shorts as neither side has been given the green light of conviction to push their positions. Most indexes have neither made a new high since late July nor made a new low since early October. Taking positions in either direction right now is akin to being a Lima been in the mouth of a four year old- a high probability of getting chewed up and spit out. Right now patience truly is a virtue.

Thursday, December 8, 2011

Sentiment During Bear Markets

I was directed to this excellent piece, The Ten Key Differences Between Bull and Bear Rallies on TraderLog and thought point 6: Market sentiment responds differently in bull and bear markets --is especially pertinent. The key point made is this, "Bear markets on the other hand, slide down the slope of hope and are generally accompanied by extreme highs in sentiment followed by extreme lows (highs in bearish sentiment) which is another reason why volatility is higher during bear markets." This can easily be put in context with a quick perusal of the AAII sentiment survey results:

There is also a striking difference of opinion as contrasted with the vacillation of the Investors Intelligence survey during this time which in comparison looks quite bullish overall.

|

| AAII Sentiment |

There is also a striking difference of opinion as contrasted with the vacillation of the Investors Intelligence survey during this time which in comparison looks quite bullish overall.

|

| Investor Intelligence |

Sunday, December 4, 2011

Weekend Review 12/02/11

With the announcement this week of further liquidity being pumped into the market, “Don't Fight the Fed” is the name of the game, but what are the rules? It's been noted recently on Bespoke which stocks are currently “en vogue” and this is also echoed on StockBee. This can be quickly verified by sorting the Russell 2000 by price percent change 5 days. The index returned 10% this week but the leaders are for the most part junk and bottom fishing candidates. Perhaps these improbable candidates will indeed be the next wave of leadership.

| Russel 2000 5 Day Price Percent Change |

This action this week reminded me of a paragraph in Trade Like an O'Neil Disciple:

The year 2009 was what William O'Neil himself called the most challenging year of his career... It was a year led by junk-off-the-bottom(JOB) stocks, while the more quality names often floundered. Many technical indicators that had worked for many years stopped working... 2009 was the year of the Fed “funny money” market manipulations as the Federal Reserve, in concert with central banks around the globe, injected huge amounts of liquidity into the financial system... pg. 237

Coming into the close of 2011, the Russell is down 1.09% from 12/01/10. On a weekly basis there have been wild gyrations, but smooth the perspective through time and the index has barely budged. This has been a central theme through a year in which the index has been bisected with an upper and lower range where fast and large moves to the up and down have been the norm. Although I'm coming into this week cautiously bullish, I'm not exactly eager to begin entering positions as I have the same sensation I get when I'm in a casino where the house always wins.

Wednesday, November 30, 2011

North by North East

If a man knows not to which port he sails, no wind is favorable.

--Seneca

Knowing when to walk unhindered and not use what one thought yesterday as a crutch today is a critical nuance to learn. The impression I had coming into this week is no longer what I hold today. Two key indicators I use to market time have both aligned bullish and this is a cue for me to begin to look for long opportunities. In addition, there were 1950 stocks in my universe up 4%+ on higher volume then yesterday bringing the breadth ratio I watch to 1.98 indicating a thrust is imminent

|

| Primary 11/30 |

|

| Secondary 11/30 |

Monday, November 28, 2011

NBA lockout ends, Market Rallies

In an unexpected twist, after the worst Thanksgiving since 1932, the market rebounded suggesting it may be a Merry Christmas after all. While it's still early to call, developments look promising as the market responded well to the news that the NBA lockout has ended and will tip off in sync with the holiday. The correlation to the market was uncanny as the labor talks after weeks of going no where and breaking down offered a positive surprise and the NASDAQ responded in kind with a 3.52% increase.

When pressed about the recent developments, NBA commissioner David Stern responded that: “We realized we were all being selfish and unfair in our approach and that we should start thinking of the bigger picture. The rumors of Occupy Wall Street moving into Madison Square Garden made us really think about our effect upon the economy as a whole and where all those executives receiving their well deserved bonuses would be spending it this holiday season. We thought, what better place than Madison Square Garden? Also, after getting a call from sponsors we realized that not only had the specter of and NFL lockout put a gloom on the sports related economy, but an NBA lockout as well would be too much. We didn't fully understand our responsibility in delivering our product on time even if it is overpriced and watered down”

In response, couch potatoes across the country rejoiced and market participants did as well in anticipation of an all you can eat buffet for couch potatoes across the country: PZZA and BWLD responded well gaining 5.68% and 8.24% respectively while SAM gave cheers with a healthy gain of 3.41% as MSG finished the day up 10%.

Sunday, November 27, 2011

Weekend Review 11/25/11

Looking at some of the headlines this week I couldn't help but be reminded of the refrigerators I use to see littered with magnetized words displaced across the surface with the occasional attempt at haiku or limerick. Grab a salad bowl and toss in the the phrases “Worse week since” or “Biggest drop since” or “Fastest rebound since” and mix in some dates of the most notable market years like '29', or '32', or '33', or '74', or '87', and the ensuing article nearly writes itself. It seems this is the worst Thanksgiving week since '32' and not simply because the mystery shoppers are using pepper spray to gain an edge on their competitors!

Considering this is the worst Thanksgiving week in 80 years, it does give pause how much worse this week could have been if a day and a half wasn't lopped off due to the holiday. The Russell gave up 7.4% this week, closing at a near demonic 666.16. 639.85 now becomes a key price point as this was the August 9th low which held as the floor for the majority of the ensuing price action and as such will be viewed as support. The next price point that will be of significance is 601.71 as this is the price that has been construed as the market bottom and if challenged will weigh heavy on the market psyche like an anchor.

Of note this week is that pessimism has increased as indicated by the AAII survey showing and increase in bearishness by 7.8%, and in conjunction with this the overall health of the market is still showing deterioration.

|

| Russel Weekly Chart |

|

| Primary |

|

| Secondary |

|

| $BPNYA |

|

| $USHL5 |

With the Market Monitor Primary moving bearish this week and New High/New Low continuing downward the preponderance of evidence continues to indicate a market ill suited for my style and horizon. With a number of indexes such as the Russel and NYSE approaching the bottom of their range and key price points coupled with a continued influx of news, my belief is that there is a lot of emotion playing out right now that has yet to become exhausted. These ingredients are a mixture for volatility and in this state negative surprises can result in disproportionate moves.

Saturday, November 26, 2011

As AAPL goes...

A good quality leadership stock in a bear market is like a camp counselor in a horror flick; generally the counselor survives in order to tell the tale and pass on the mythos of horror only to find themselves the first victim of the sequel. Looking over the landscape of leaders, many managed to escape the first down leg from late July into early August unscathed, but as the market appears to be deteriorating further, it is worth keeping an eye on these.

Stan Weinstein shares a method in Secrets or Profiting in Bull and Bear Markets entitled "As GM goes"

- Four Month Rule: If GM doesn't make a new high (or low) within four months it is a signal that GMs prevailing trend is reversing.

- When it completes a Stage 3 top and breaks down into Stage 4, it's time to worry even if a new GM high was hit last month.

- When GM refuses to make a new high (or low) in tandem with the DJI and the other leading averages, it's an early warning that you'd better be alert.

His logic behind this is:

The market is not a democracy. The bullish and bearish votes that each stock casts toward the major trend most definitely do not count equally. The most heavily traded and institutional favorites matter far more... Of all these shakers and movers, there is one that you must always keep your eyes glued to --General Motors. Never listen to the message of this key stock in a vacuum, but when it flashes a major signal that is in sync with the majority of the gauges in this chapter, do not ignore it! pg 297-297It's safe to say that General Motors does not wield the significance and sway it once had. There are new leaders that have emerged and clearly the most watched and mentioned is Apple. Not only is it discussed and defended with zealotry on message boards, chat rooms and social media outlets, but people are also willing to make pilgrimages cross country to where it all began or will wait in line for hours if not days to be the first to get a new product. In fact, recent studies involving fMRI scans have indicated that Apple has the same effect upon its followers as religions do among theirs.

So, while it is simple enough to replace GM with APPL, there are a number of other institutional darlings that should also grab one's attention. Stocks such as AMZN, BIDU, CMG and PCLN are note worthy in their own right. Given that many of these stocks managed to act well and stave off the first wave of clawing, how these stocks behave given the current market action will be telling. If there is another round of clawing, will these stocks survive the opening scene of the sequel?

|

| AAPL |

|

| AMZN |

|

| BIDU |

|

| CMG |

|

| PCLN |

Wednesday, November 23, 2011

Nomentum

My trading universe is dynamically generated, but has been consistently in the range of 2600-2700 stocks which constitutes a little less than half of the current Worden universe of 5778. Using one of the more common gauges of momentum, Price Percent Change 26-Weeks results in 352 above 0. If I wanted to get picky and reduce this list further I could remove the buy-outs, but this would do nothing to change the fact that 2286 stocks in my universe are negative.

Sunday, November 20, 2011

Survey Says

As a budding trader, one of my goals has been to study market breadth from different perspectives to better pinpoint trading zones. Through numerous posts I've delved into various methodologies and measures to get a pulse on what the market is currently doing. With each study I've become better informed of the merits, nuances, pluses and minuses of these various indicators. At some point however it becomes important to take ownership of them and make them my own.

Having analyzed my trades and journals over the past month, I've increased my awareness of my trading style and the periods where I've had success and the periods where I've broken form. As I further clarify and hone in on my style and the strategy and tactics I will begin to execute, I've also filtered various market breadth tools through these methods to create a more cohesive model. My focus is locating periods of confluence between these indicators suggesting the market is healthy enough to take action.

Looking at the market this week I see absolutely no reason to be involved in trading what-so-ever. The indicators I use are showing confluence –to the downside. As a trader of momentum based swing techniques, the primary vehicle selection I use is small cap stocks. Considering this, the index that is of primary significance to me is the Russell 2000 as this indicates not only the over all health of the small caps, but also is construed as an indicator of a risk averse or risk taking market. A look at this index using stage analysis clearly indicates Stage 4 is in progress as price is below a declining 30 week moving average.

|

| Russell 2000 Stage 4 |

Next, looking at a graph of the Primary and Secondary indicators of the Market Monitor, there is a jagged down trend on the Primary, and a cascading downward slope on the Secondary. As the Secondary is a measure of stocks moving over the past 34 days and with this bounce commencing 34 days ago, there is a high probability that this indicator will go bearish this upcoming week and if so, the Primary moving bearish is likely to follow.

|

| Market Monitor Primary |

|

| Market Monitor Secondary |

The 5 day NH/NL has continued to decline since peaking on 10/28. A decrease of highs suggest there are not participants willing to buy dearer, so it makes little sense to buy if I won't be able to find sellers later.

|

| $USHL5 11/18/11 |

One last technical indicator I will be using from this time forward is the $BPNYA, which currently flashed “Bull Correction.”

|

| $BPNYA 11/18/11 |

Given that the market moves of 1%+/- are the norm, the current market is acting quite “emotional.” As I've come to understand with greater clarity, emotional states can lead to unexpected outcomes. This chop is not the environment that I choose to trade and given my current read of the indicators I'm using, the market is not in cadence with my methods and as such sitting on the sidelines is in my best interest until they begin to firm.

Friday, November 18, 2011

Promises

Promises are shitWe speak the words we breathPresent air will have to doRearrange and see it throughStupid fucking wordsThey tangle us in our desiresFree me from this give and takeFree me from this great debate --Fugazi

Over the past year I've accumulated nearly 4 volumes of hand written journals, coupled with a daily market journal. I don't have to rely upon my memory alone to recreate the accounts which is beneficial since having a series of notes in real time has been useful to envision with better accuracy what exactly I was thinking or feeling at the time. Themes clearly stood out.

I expressed in a recent post a disheartening experience: going through my journal posts and noting the same theme from a post a week previous that extended a run on sentence from my second journal entry a year previous. I wasn't completely ignoring the issue as evident by the numerous entries, however I was clearly –perhaps intentionally –oblivious to investigating further and/or modifying the behavior regardless of it being in my best interest to do so. I wasn't so much blind as myopic since I could see it – however fuzzily, but...

Upon repeated readings a disturbing thought evoked, I was a victim of an internal domestic dispute and each hollow promise took on the intonation associated with the phrase, “I promise baby, I'll never hurt you again!” Suddenly my journals felt like a never ending episode of Cops projected on my eyelids and I couldn't find the remote to change the channel. For a period of time I was dejected and demoralized, but I realized this state of mind would accomplish little and that if ever there was a time to change this behavior it was now.

It was during this moment of perturbation that I decided to rephrase the questions I asked myself. It isn't so much about asking the right questions since this presupposes knowing the corresponding answer, but merely asking any and all questions because it can not be known which one will be jarring. Through asking questions it became clearer that if I simply took the time to address what I neglected to begin with, and it wasn't a very difficult task really, then not only is a burden lifted, but the knowledge gleamed from this process could be applied to other behaviors that needed to be altered as well. Instead of being blinded by the problems like sun through a windshield, they'd begin to tip over like dominoes.

Proceeding through each journal I began to maintain a bucket list of key words and phrases, as well as core ideas and concepts that repeated throughout. There were plenty of “promises” clustered through the pages, the usual suspects: trade the plan, keep the stops, exit at profits, don't do this or that again, why the fuck did I do it again; page after page of discomfort and pain like stick figure illustrations found in the corner pages of a grade school text book that when flipped animate.

One of the values of journaling every day is that unbeknownst to be at the time I was in essence building a composite of myself –if I was willing to listen. Since each book is specific to one task at hand- trading and the frame work thereof, I have built over time a self-character and have pinpointed quite clearly where my strength and weaknesses are. From this, I am better informed of where my attention should be drawn and more importantly have a better understanding of my trading persona. From this I can now become better specified in what works for me, what methods and strategies to employ, and how to build working methods around my personality that mesh and feel like a natural extension of who I am.

It is said that insanity is trying the same thing over expecting a different outcome, however when the outcome results in a light bulb it is called genius. Perseverance as exhibited by the likes of Edison is considered virtuous, but the same thought repeated ad infinitum in a note book –neurotic compulsiveness. Perhaps this is a legitimate differentiation, and perhaps in doing the same thing every day I'm skirting the thin veil of insanity, but perhaps one time I'll have that AHA! sensation after a thousand disappointments as well.

|

| Approximately a years worth of journals |

First go through and create a bucket list of what repeats time again. Consistent repetition of an idea signifies importance.

Identify and separate habits and problem spots and prioritize by those that can be broken and/or managed the easiest and are the most controllable, even if it is something as simple as not getting enough rest, or poor diet, or exercise. Resolving the simplest will be an accomplishment, and build skills and insight on dealing with others, and perhaps some might be instantly resolved or simplify from there forward. It's important though to complete one before moving onward.

Research as thoroughly as possible the problem spots that time and again manifest in the journal and are the most difficult to break. Find skills to resolve them, study how others have resolved them or reach out and ask someone else.

Categorize the consistent themes of trading ideas and concepts. Build your personal composite trader. What style is that trader drawn to? What captures that traders imagination? What comforts or discomforts that trader? Ask as many questions of who that trader is and then ask questions about the trader you are now. Do they mesh or are you choosing to be a trader you want to be and not the trader you are?

Wednesday, November 16, 2011

Narrow, but Loose

Wednesday, November 9, 2011

Stealth Bear?

There's a market maxim: Bulls make money, Bears make money, but P.I.I.G.S get slaughtered. The narrative over the past few months has been headline driven by news from Europe, but this isn't anything recent as “Greece” has been the word for over a year now. Not to be outdone, Italy dominated the financial headlines thus far this week, and perhaps next week Spain sheepishly will regain the spotlight. I have no pretense I can make heads or tails of this, but one thought did pop up today as I found myself looking at some recent earnings as well as the SPX YTD and recalled a passage from Tom Dorsey's Point and Figure Charting.

The market of 1994 has been dubbed the “stealth bear market.” The indexes were holding up, coming in even for the year, but the sector rotation in the market was unbelievable. As one sector was getting hit, another was recovering from its sell off; the effect of this was to cancel each other out in the broad market indexes. However, individual stocks and many investors did not fare as well.

Looking at the SPX, YTD -1.37% as of today. Coming into the close of the year the index is basically where it started the year.

|

| SP Year To Date |

What struck me from observing earnings this season is how swiftly those with poor earnings or perceived poor earnings are getting punished. This theme is evident today from the charts of ROVI and NILE, both taking 30% cuts. Whether or not the 2011 year closes out analogous to 1994 with earnings playing the predominant roll remains to be seen, but the tone is being set.

|

| ROVI After Earnings |

|

| NILE After Earnings |

Saturday, November 5, 2011

HAL!

Within the time it took my mind to register something was amiss I felt that queasy feeling in the pit of my stomach I usually experience a time or two as a boat pitches from a turbulent sea. Prior to this I was, not unlike usual, searching for something during a time when I shouldn't have been and I was conscious of my thoughts and reminded myself, “Didn't I just say I wouldn't distract myself?” The impulse gripped me however which I at least found entertaining for a moment because it highlighted exactly what I was addressing, only this time I was aware of the act itself and not letting it go without acknowledging. As I was admonishing myself for this modes transgression I saw the Java splash screen and thought, “This can't be good.”

As if that wasn't enough of a sign, my browser crashing and the dozens of pop up alerts layered like pancakes followed by an alert that my drive was malfunctioning and informing me to click “Yes” if I wanted to fix this heightened the sinking feeling. I thought against that and did a quick scan which alerted me to 4 trojans which I quarantined and restarted. I was thinking I was in the clear as I rebooted but that feeling didn't last long as everything came to a screeching halt when the screen went black and a cursor began blinking in the upper left corner.

After another reboot and letting some minutes pass I knew I was screwed on this and it was simply a matter of dealing with it. As I dual boot on my Mac Book, I booted up OS X and took the time to do a complete system back up before opening up the patient hoping the guts wouldn't spill out. This took over 4 hours, but at least I managed to back up all documentation on both partitions. After this I spent an hour researching the problem and came across a number of solutions that I proceeded to move through one by one with each step getting closer to the least desired result, completely hosing the partition and reinstalling everything.

As hour after hour passed and the sun set I became increasingly frustrated and more despondent. I managed to resolve the blinking cursor, only to encounter another stumbling block- “missing or corrupted hal.dll.” In researching this I found out it is a common problem with dual boot Macs so I figured with 100s of hits there should be a one size fits all problem. Yes and No. There were a few solutions but most did involve a complete partition reformatting. After spending more time not succeeding at this and questioning how much more effort I wanted to put into this I finally decided to wipe and start over.

The irony does not escape me that Hal would have something to do with this. Nor does the irony escape me that what I was focused upon for the past two weeks manifest itself in a computer malfunction, after all this is something I know much better about and yet... I still don't do anything about it. I know periodic back ups and I know up to date virus protection and the periodic disk management and hard ware diagnostics are important but I continually opt to be neglectful of this. This isn't even the fourth time something like this has happened to me- for whatever reason having MBRs swiped, hard drives click to death, mother boards fry, and the occasional complete system collapse, I obviously haven't found these negative events significant enough to apply best practices.

The serendipity of this system crash carried weighted significance this time because it uncannily coincided during a period where I was documenting and researching exactly this phenomena –the gap between knowing and doing. I was in the process of starting a series about what I have come to understand about this disconnect inspired from going through my trading journals and coming across a post that I found disheartening. It was my second journal post and I felt the knife twist in my belly as I recognized it was virtually the same post from a week previous.

Things worsened as I noted this crept up time again through my post and I documented a consistent theme, tone, verbiage, and insight that permeated this body of work until I felt like I was in Borges' “Library of Babel.” The sheer repetition page after page after page had gone unaware for so long I felt like staring at a spring leaf wondering if I'd notice the moment of discoloration the fall brings. Also, it wasn't like I was unaware of this, there were plenty of post where I noted my previous notes and that this was beginning to be a narration of neurosis but even that was not enough to make a behavioral change.

Making behavioral changes has become the theme I've committed to over the past few weeks, absorbing as much modern research as possible and documenting points that are significant to me. Having gone through my past journals and trades I've come to a realization that I don't know what I am doing correctly, but what I am doing erroneously is a clear as Bart Simpson and a chalk board.

“If I knew then what I know now I would have...” What would I do? Now is my opportunity, an opportunity to start with that blank slate and choose what is important for me to rebuild. The confines of my habits have been broken. I can no longer boot up and move from A through Z before I even realize I've done just that. The dozens of TC2000 V7 scans I have and don't even know why any more but found myself attached to regardless because one day they might prove useful –gone. All the book marks I'd cycle through on my browser and I didn't know why –gone.

What at first started off as a soul crush morphed into a lightness. Yeah, it's a pain in the ass rebuilding, but now it's a clean install and a fresh environment devoid of habituation. OK, it's not like I've lost all my scans and book marks, they are backed up after all, but it's an opportunity to simplify and rebuild my user space around a behavioral change of intention and action. I've become accustomed to a process flow that was counter-productive and was beginning to make key changes to my process loop, this simply expedited the situation by force.

A number of my past post have been about market breadth and I've been looking for a new topic to approach and this seems like the time to do such. It's my plan over the upcoming weeks to begin a series of post relating to topics involving modern neuroscience and the light it sheds upon trading and in turn shed light and increase awareness of my own knowledge about a subject that I've come to realize effects me much greater than I originally believed.

Sunday, October 23, 2011

Looking Forward by Looking Back

For a period of time Guppy Multiple Moving Averages captured my imagination and I spent a godly amount of hours analyzing them. One of the main problems I now realize I had at the time was content sans context. While I understood the core nature of trend trading and what it represented, I was lacking a deeper understanding of market mechanics and the relationship between complete set ups and being able to act upon them. As a result I was looking for some magical transformation in my knowledge yet still ended up in a desert using sandpaper as a map.

Over the past two weeks I've been revisiting old notes in order to see what progress I have made. At times I find myself utterly absorbed trying to take the next step I neglect to stop and look around and take a gander at the view. Lately I've found myself repeating a number of the same steps but I'd never know because the scenery is full of dunes and the wind keeps sweeping away my foot prints. Considering this I found it necessary to get my bearings and review.

| |

| GMMA Trend Velocity |

One of the techniques of GMMA is the Trend Volatility Line, which I've dubbed Trend Velocity Line. Darryl Guppy explains the mechanics of this on his website. Using these basics, I would move day by day across various charts and document the number of days it would take the 30 EMA to catch up in price to the 15EMA, and the separation and compression of the longer term averages. Additional notes I took were the pull back zones, pinpointing entry signals based upon price breaking the previous peak of the 3 EMA. As much as I tried to make this work at the time, I never quite could. In retrospect, I can now see that I had a full trading system to implement, but I also realize there were some fundamentals lacking in my play book to make something like this work for me.

Currently one of the market structures I've been studying is momentum. With a clearer understanding of the mechanics and measurements of momentum I decided to take another gander using the NASDAQ since 07/27. I've illustrated key periods of interaction between the traders and investors and how I would now interpret this action. There are four zones where the traders made rally attempts and in each zone the interaction of the investors is telling.

|

| NASDAQ GMMA Analysis |

Rally Attempt 1 shows a bounce by the traders, but this quickly fails as the fastest EMAs, the 3 and 5 period barely align to the upside before breaking down.

Rally Attempt 2 shows a crossing of the short term EMAs and price begins to enter into the range of the investors, which in the theory of GMMA analysis are important because it is their buying that ultimately supports the move. In this zone these longer term averages begin to show some support as evident by the flattening of the 30 and 35 EMAs, but not enough as this rally break fails. Further, the short term EMAs did not have a full cross over and realignment to the upside suggesting this attempt has a high probability of failure.

Rally Attempt 3 shows price breaking above the longer term averages and also shows them beginning to compress and flatten out indicating that the there may be some support showing up here from the investors. The velocity of these longer term moving averages is also beginning to slow in this area.

Rally Attempt 4 shows a confluence of price above the longer term averages, a complete alignment of the shorter term to the upside, and further flattening and compression of the longer term averages. As of 10/21/11, these averages are beginning to cross over themselves and realign to the upside.

|

| GMMA Separation Count |

Another way of looking at this is the rate of change of the longer term averages as represented by the difference between the 30 and 60 day EMAs. The peak separation was 106 and from there I've jotted at 5 day intervals the separation of these. Additionally, I plotted the number of days it takes the 30EMA to catch the 15 EMA price- between 08/12 this took 6 trading days. On that date I draw a trend line down to where the 15 EMA is and from that price draw a trend line across the chart. As can be seen, this lines has stood for 43 trading days without breaking.

Some other key factors that have become clearer in revisiting some of my old notes and applying it to my studies of underlying market breadth is that the signals given by the the GMMA have been in time with the other indicators I use. The Stock Bee Market Monitor that I use signaled bearishness on 07/27 and the following day the GMMA crossed to the downside.

| MM Bearish Signal |

Comparing the GMMA to the $BPNYA, the $BPNYA gave a Bull Alert on 10/11, the GMMA crossed to the upside on 10/18, and the $BPNYA gave a Bull Confirmed signal on 10/10. Again, this signal is in line during this period at least. And the Market Monitor I use also indicates bullishness.

| MM Bullish Signal |

In placing my former thoughts through a sieve of current context I'm attempting to create continuity and bridge some gaps that I had at the time and some of which I continue to have. In some ways what I thought at the time isn't much different then what I think now and this has both positive and negative connotations. By taking time to review I can more clearly see where I am dog paddling, where I am swimming, and where I am drowning. More importantly I view this as a process of demystifying tools and indicators to avoid the trap of looking for something special when there are more significant areas where energy should be directed. All three tools are closely correlated in their timing and each have limitations, but the greater limitation is not being able to do anything about the signal.

Tuesday, October 11, 2011

Bull Snort

|

| $BPNYA |

Sunday, October 9, 2011

Be Afraid!

In 1637, a theorem was penned in the margin of Arithmetica-- Fermats Last Theorem. Over the next three centuries the brightest minds on this planet took up the gauntlet and attempted a proof. If something postulated in the margin of a book in a language understood across the globe regardless of one's mother tongue took over 300 years to prove under rigorous testing and became accepted, exactly how is a problem like the world economy with specific interest to each country going to be resolved in short term, and by politician to boot?

We can't solve problems by using the same kind of thinking we used when we created them--Albert Einstein

That politicians can accomplish anything is stupefying enough, but that they can actually do anything about the world economy, something they have repeatedly shown to be inept at and without expertise of, and in many cases actually participants in destabilizing, is pure silliness. In addition, the belief that the scale of the world economy can be simplified by man into a theorem that can be scribed into the margin of a book to be proved verges on hubris.

That being said, the cover of the recent Economist in a few words, 'Be Afraid' , emblazoned upon space small enough to be in a margin does speak of a proof understood by market participants- contrarianism. In many ways this makes sense because if the belief is that politician have the solution, what exactly is the expertise of these journalist and editors to make such bold claims to begin with? Astute market participants have noted through empirical evidence that when the head lines of major magazines and news papers become apocalyptic in tone about the economy, the market tends to disagree.

|

| Economist 10/01/11 Cover |

Taking this into context, I return to where my thoughts left off. Last week I posted a few charts and noted the precarious position of the Russell sitting at the bottom of the range formed since August. Having clipped this low twice in a week and having a recent close below it, I believed there was a high probability this low would break. At the lower end of the range I placed an oval followed by three question marks because even with the weight of evidence suggesting a break to me, nothing is certain. On Monday the low was broken with a convincing 5%+ drop in for the session. A follow through on this was what I expected as the speculative line of least resistance suggested further cascading, however this is not what transpired; and while a pause the following day was not out of the question, a 6.41% pop completely bamboozled me and carried price straight back into the range.

|

| Russell 2000 10/07/11 |

On a weekly chart, the SP-500 broke the bottom of its range as well yet finished with a close in proximity to the upper third of the move. I've chosen not to extend the boundaries of the range I defined four weeks ago because I did not want to simply highlight the complete price range into obscurity, but rather emphasize the price move in context over time.

|

| SP-500 Weekly |

Looking over the landscape this week what is patently obvious by now is that this is an exceptionally volatile range bound market, with Grand Daddy Dow having 4 moves of 1%+ over the week while Uncle Russell had moves of -5.8%, 6.42%, 1.46%, 2.38%, and -2.61%. With Tuesday commencing earnings season and a couple of key companies reporting thereafter, an important catalyst is in play. Good earnings may turn focus away from the news events that have been a driving force behind the market these past few months. If this begins to look like a poor earnings season, those 3 question marks might be removed..

Sunday, October 2, 2011

The Other Side of the Penny

| FinViz Top 5 |

Over time I've looked at the Top 20 Morningstar Industries price percentage change over one month for clues relating to investor sentiment. Every coin has its flip side, and after looking at the recent list and being unable to make it past 5 that have had ended up positive, I thought about flipping the coin and looking at the bottom 20.

|

| FinViz Bottom 20 |

Discounting the first slot, Music & Video Stores which is basically Netflix, the 2nd and 3rd slot are worth highlighting. Copper and Aluminum are used as barometers of economic health and noting that they have led the pack to the downside is something worth paying particular attention to. On October 11th earnings season kicks off with Alcoa's announcement and considering the current environment, this is an important catalyst to be aware of.

For further research, a recent article regarding copper from the Economist

Saturday, October 1, 2011

Ruh-Roh, Again?

2011 is the year of the rabbit, but it may as well be known as the year of the range as well. With the exception of the final leg up through January and the ferocious sell off of late July, the market had been oscillating within a consistent range from February onward before cracking on July 27th. As exemplified by the following chart of the SPY, the rapid sell off from late July finally settled down on August 8th where the lowest close printed followed by range with high volatility.

|

| SPY Year to Date |

Returning to a previous chart I've (posted),

|

| SP-500 |

the SP-500 on a weekly time frame continues within the price range boxed at the time. From the perspective of Weinstein this is clearly stage 4 with price below a declining 30 week moving average and from the perspective of Wyckoff it remains to be seen if this is redistribution before another leg of mark down. On the chart I make a note at the bottom of the range, “If range breaks... Speculative Line of Least Resistance.” For an explanation of this I turn to Edwin Lefervre's classic Reminiscences of a Stock Operator:

This experience has been the experience of so many traders so many times that I can give this rule: In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be—up or down. The thing to do is to watch the market, read the tape to determine the limits of the get-nowhere prices, and make up your mind that you will not take an interest until the price breaks through the limit in either direction. A speculator must concern himself with making money out of the market and not with insisting that the tape must agree with him.

Therefore, the thing to determine is the speculative line of least resistance at the moment of trading; and what he should wait for is the moment when that line defines itself, because that is his signal to get busy.

While the major indexes are still boxed in their range, one significant index is not, the Russell 2000. The Russell has closed under its August 8th print on 09/22 and again on 09/28. Having pierced this close twice and considering that indexes are a lagging indicator to begin with, this portends more down side looming on the horizon; and as the Russell also has a characteristic of being a leading index, being one of the first to break the range carries additional weight. While it is not up to me to determine the limits of these get-nowhere prices, another mark down period is looking highly probably and preparing for such would be prudent.

| |

| Russell 2000 09/30 |

In addition, however one wishes to define a bear market: a key index below a 50 or 200 MA, below a 30 week MA, down 20%+, the Russell clearly fits all of these definitions so it is also important to keep in perspective that a range in a bear market will exhibit different behavior tendencies than a range in a bull market. Any thoughts I had that this is going to be a simple correction have been dismissed. It's important for me to recognize this if only for the simple fact that it helps me study this market in its proper context and cater my learning towards what it is expressing upon me and not what I want it to be doing based upon what I am studying.

Monday, September 26, 2011

Who is Vince?

Over the weekend I started to think about Vince and who he might have been. Perhaps he was of the stoic belief orating next to a pillar outside the Pantheon in Rome, or a cynic orating out side the steps of the cathedral in Florence. Maybe he was a simple farmer outside of Sienna with a desirable daughter. Whoever he was, I imagine a conversation along the lines of this:

I need you to con Vince.

- Why do you want me to con Vince?

I don't pay you to ask questions.

- What do you want me to con Vince of?

Again, I don't pay you to ask questions, but that's an important one so I'll tell you what I want you to con Vince of...

I don't believe this is the etymology of the word convince by any means, but this idea did have the unintended effect of beginning a sequence of thoughts that framed my current state of mindfulness regarding what is transpiring around me and how I have interpreted it. Over the course of the past few months I've patched together a number of concepts from market participants who have directly or indirectly had their thoughts scribed --thoughts that have stood the test of time and market cycles.

Of Livermore, Wyckoff, O'Neal, Weinsten and Zwieg, I have taken a tidbit of wisdom and applied their model and methodology as a template to the market since May. From each I have focused primarily upon changes of market character and trend change from from bullish zones and topping zones to distribution and mark down with some thoughts on the bottoming process as well. What each post did however, was the contrary to the intention and if anything made me more optimistic, but without justification. As I reflect back upon each post I can't not help but acknowledge that I was trying to convince myself of something- but what wasn't apparent until recently.

Over that past few days I've taken to reviewing my daily logs checking for repetition of key words and phrases and noting what actions I did take to address them and which received inaction. It should come as no surprise to me to see the same blocks of writing alerting me to something neglected. Weeks later these would pop up again and sometimes months later as well. This repetition was the clearest sign that I was ignoring vital information pertaining to myself as a market participant. Of one note from February I take particular awareness of now:

There are certain weaknesses that when overcome show more- and that is one of the difficulties of trading- you get over one hump and your digging yourself out of another ditch and it gets tiring after a while and you start to wonder when is this going to change- I got over the fear of entering- I got over the fear of exiting loses- O.K.. Now I have the fear of mismanaging trades- it's a permanent state of anxiety and you become anxious that once you modify the current road block you'll find another you hadn't though of-

Here in lies an astute truth about my market beliefs. What I've come to learn through trading is that a solution today creates a problem tomorrow I may not have even thought about yet. Improving as a trader has a counter-intuitive challenge that as I become better experienced I can also become worse through the pursuit. The more informed and the less ignorant the higher the hurdle to overcome looms. This is why persistence and resiliency are two very important attributes to have in trading because with each step there is a chance of tripping and unless these two characteristics are honed, it might be the last step for many due to sheer frustration.

Sunday, September 18, 2011

What's In Your Tool Box?

Education is hanging around until you've caught on.Robert Frost

Over the past couple of months I've been analyzing sector rotation on a weekend basis. Prior to this I've tried to develop some tools to make better use of sectors and their rotation with limited success. Yet every day I keep plugging in sector information because I know it is important and significant and I also know why it is considered to be important and significant; however that doesn't mean I know how to make use of it for myself.

I kept scratching the surface and figured as long as I continued doing so eventually I'd get to the primer and perhaps deeper still. With time I did begin to peel back some layers and realized there were some severe short comings and limitations to how I was addressing this information. Information is abundant but without a plan to filter and manage -often useless. More information is not necessarily going to lead to better decisions, neither is better information without a process of applying it going to lead to improved decisions.

Once I started digging a little deeper I began to see the limitations of my applying this information and the delusion of knowledge evaporated. I had no realization that many of the Morningstar Industry Groups have 2 or 3 stock attributes so their significance of being in the top 20 becomes negligible, perhaps even lacking relevance at all. Some also have such limited volume that their significance is skewed as well. In acknowledging their limitations, their usefulness became better understood as well and a personalized process of application opened up, too.

Fin Viz uses the same data stream as TeleChart when it comes to its sectors, so it is an easy transition understanding the inherent limitations of this information. One benefit that Fin Viz has is its efficiency in moving back and forth between the sectors and the stocks that they comprise, as well as quick visual glances at the underlying chart formations. There is another tool that can be used with these sectors and that is running them through the stock screen. These two combine into a powerful tool of sector and stock scanning, as well as an idea generator.

The first step is sorting the Industries by one month performance using Fin Viz

From this list I look at the top 20.

|

| Top 20 from Fin Viz |

Now that I have a list of the top 20 the next process is to use the Fin Viz Screener tool. My set up is fairly simple:

- small cap stocks

- up over the past half year

- over $3

- 100K average volume

- 10% or less below 52 wk high

Then I go through each of the Industries that are listed and check out which stocks meet the requirements. From this list I can now focus on those with charts that are consolidating in anticipation of the next swing up.

Having gone through this scan over the weekend, the main Industry that clearly stands out meeting the screen is the Apparel Industry.

|

| Apparel Industry |

As this is the time to begin keeping robust watch lists and looking for the next leaders, this may be one group to keep in mind down the road. There are a number of ways to configure this to one's taste and rapidly generate trade ideas in keeping with one's methodology.

Subscribe to:

Posts (Atom)