One set up that I continue to explore is anticipation entry before a break out, however rather then waiting for an actionable price entry signal I've been honing in on buying during price contraction. The inspiration for traversing down this path was the lack of follow through on my vehicle selection through much of January and early February. As with most investigations, the market wagging the dog and potential style drift should be acknowledged. Whenever exploring new ideas it is important to filter them through one's trading philosophy and determine whether or not it compliments current set ups or not. I've done this by reverse engineering my current set up and focusing not on ensuing price action after entry, but rather the action leading up to it and one of the immediate benefits was recognizing where better triggers or price patterns were available.

An inherent problem to address with entering prior to a break out is having capital tied up in a stock that is not moving. It's of paramount importance to be exceptionally selective in vehicle selection and awareness of price action and stocks that have a higher probability of putting on the jets in the near term. As I test this out my current willingness to hold is ten days without movement but market dependent I'll be looking to drop this down to five because in a strong environment like last week, holding for a prolonged period results in missed opportunities cost elsewhere as capital is not available.

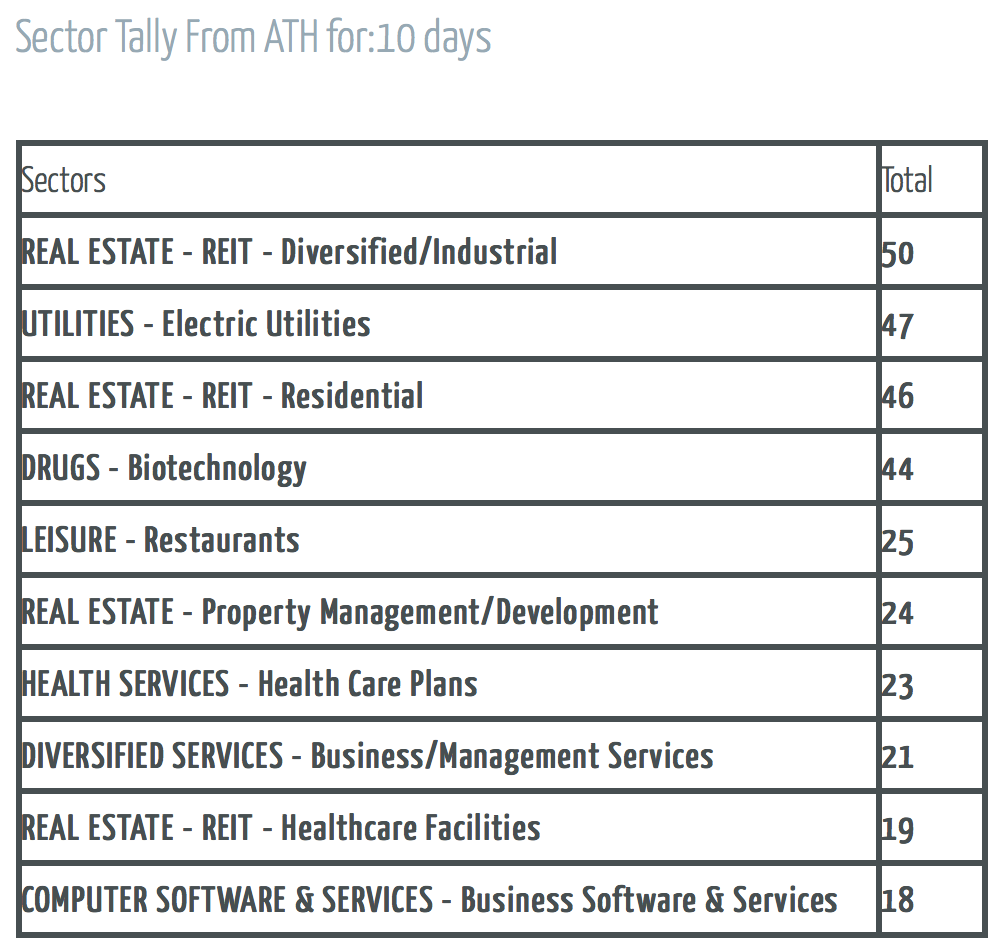

Currently I've developed two scans to narrow down my opportunities. I've isolated stocks that are up 25%+ between 20 through 40 days ago, stocks that are up 25%+ the past 20 days, and stocks over $100 that have moved $15+ in the past 20 days. I'm focused on stocks that have had strong price/volume moves and have recently shown exceptional strength. Further refinement is focusing on stocks that have had a near term catalyst, particularly earnings. In addition I'm narrowing my list down further by sectors that have been rotated into as well as probability stacking through low float/high short interest stocks. Essentially this is a mealy-mouth means of stating I'm looking for stocks with oomph.

Unlike break out trading where I am looking for expansion with high volume, in this set up I am looking for narrow range days with the some of the lowest volume during the consolidation phase. I'm also looking to buy within the average price zone over the past ten day period. One of the main principles behind the logic of this set up is to buy a momentum stock with recent velocity when others have lost interest. When a stock is in a quiet period it is easier to get one's price and one's size while being able to maintain a fairly tight stop that isn't adversely effected by slippage. If the stock is truly under high demand the expectation is that there will be buyers on a higher magnitude absorbing at price, and our advantage is when algo and shorter time frame players bid up and assist the the ensuing burst while being positioned early to withstand volatility and potential fading of intraday price hitting a low of day stop on the break out.

The following list is a few recent candidates that fit the set up. This is the price action I'll be looking for in the future.

|

| ORLY |

|

| AMZN |

|

| LNKD |

|

| NFLX |

|

| EBIX |

|

| SWHC |

|

| BA |

Additionally, by preparing for anticipation entry, my watch list gets refined to locate and foresee potential break out trades setting up. Having confidence to enter these trades before a break out gives me greater confidence to enter these trades on an actionable price trigger of actual break.