Today there was a confluence of signals

that suggest there is a very high probability of a correction

beginning. I never doubted the if over the past month as the market has been extended, but when did not really

crystallize until after I entered the breadth numbers. The following

graphs show three indications that the market is in trouble here.

The first and perhaps most

significant is that there were 357 stocks down 4% today. This is the first clue that there is a rush to exit the market and a follow through would suggest the beginning of panic.

|

| 4PCT |

This next graph shows that this buying to

selling over a ten day period has now gone negative. It has been waning for some time but this is the first official cross of the zero line since a positive cross in late November.

|

| 10 Day Buying/Selling |

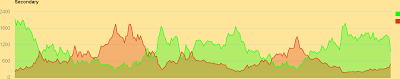

Lastly, the secondary trend indicator I

use has shown a precipitous drop since yesterday indicating that this

selling has now moved across shorter term time frames to medium term

time frames.

|

| Secondary |

If anything, going long from a swing perspective under these conditions will have a lower probability of success. From my perspective it is prudent to reign in long positions and alter my mind set from an up trending market to a change of character market and should further deterioration occur, a shorting market.

No comments:

Post a Comment