During the month of May stocks have been under distribution with 50% of the trading days showing more 4% break downs than break outs.

|

| Distribution |

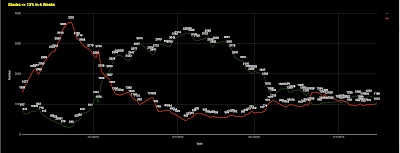

The weight of this distribution is clearly seen with the number of stocks making new highs eclipsed by the number of stocks making new lows over multiple time frames. However, the pressure on stocks has been evident going back to March.

|

| Highs Over Lows |

When the market correction reversed in late December stocks underwent a significant breadth thrust over a short period of two months. From that moment further the major indices continued to make fresh highs with underlying divergence in both the number of stocks making new highs and making significant headway. Market risk was increasing until the dam broke in May.

|

| Decreasing Breadth |

With the major indices down approximately 7 to 10% across the board, it's time to focus on a tradeable rally. The number of stocks below both their 20 and 40 period moving averages are approaching zones where in the least a reflexive bounce is to be expected if not the potential for another leg up.

|

| Stocks > 20% MA |

|

| T2108 > 40% MA |

On a longer time frame, the current pullback has brought individual stocks in my trading universe back to levels of the December turnaround. It's uncommon for stocks within my universe to reach these levels further buttressing my belief that the probability this downdraft running out of steam is near. On the other hand this period could also be like October 2018. In either case knowing what data and information one is looking for on their time frame to indicate where the market is directional moving over it is the primary determinant factor.

|

| 2 Year Breadth Trend |